15-Minute Energy Trading for Scener

Technologies:

A new trading platform built for Scener to adapt to Nordpool’s 15-minute trading intervals — completed ahead of schedule, ensuring a seamless market transition.

About Scener

Scener is an Estonia-based Energy Balance Sheet manager specializing in optimizing energy trading operations within the region. Their clients, such as factories and industrial operations, rely on Scener to secure energy at the best market prices and manage their energy purchasing efficiently.

The challenge

Nordpool, the leading power market in Europe, was transitioning from daily trading intervals to 15-minute Market Time Units (MTUs). Scener’s existing system was designed for daily bookings and could not accommodate the new trading structure. They required a new software solution that would handle real-time trading across 15-minute intervals, ensure optimal energy procurement at the best possible prices, and integrate seamlessly with Nordpool. The transition deadline placed the project under significant time pressure, requiring rapid, high-quality delivery without operational disruption.

Our approach

We applied our proven agile methodology and pair programming practices to ensure both speed and quality. The development began with a thorough understanding of Scener’s operational workflows and the Nordpool MTU requirements. We focused on building a real-time trading engine that would dynamically calculate optimal prices based on live market data and transmit orders instantly to Nordpool. Thanks to the close collaboration between our developers and Scener’s domain experts, the solution was delivered well ahead of the Nordpool transition deadline — in less than four months — allowing ample time for testing, onboarding, and fine-tuning.

The outcomes

The completed platform enables Scener’s clients to trade energy efficiently at 15-minute intervals, taking advantage of market fluctuations with real-time order generation and price optimization.

Key deliverables included:

- Real-Time Trading Capability: Traders can create and send orders to Nordpool instantly, ensuring maximum responsiveness to market changes.

- Dynamic Price Calculation: The system recalculates buy and sell prices in real-time, based on Firm Order Confirmation (FOC) data and public market prices.

- Comprehensive Statistical Reporting: Traders can analyze public and client-specific price trends, improving strategic decision-making.

- User-Centric Interface: A streamlined interface ensures that users can efficiently navigate trading functionalities and access critical market insights.

The successful implementation has strengthened Scener’s market position by enhancing their trading agility, reducing operational risks, and enabling their clients to optimize energy procurement in a fast-changing regulatory environment.

Key deliverables included:

- Real-Time Trading Capability: Traders can create and send orders to Nordpool instantly, ensuring maximum responsiveness to market changes.

- Dynamic Price Calculation: The system recalculates buy and sell prices in real-time, based on Firm Order Confirmation (FOC) data and public market prices.

- Comprehensive Statistical Reporting: Traders can analyze public and client-specific price trends, improving strategic decision-making.

- User-Centric Interface: A streamlined interface ensures that users can efficiently navigate trading functionalities and access critical market insights.

The successful implementation has strengthened Scener’s market position by enhancing their trading agility, reducing operational risks, and enabling their clients to optimize energy procurement in a fast-changing regulatory environment.

Get in touch

We love creating something to be proud of. Drop me a line or give me a call to discuss the challenges that we could help you solve.

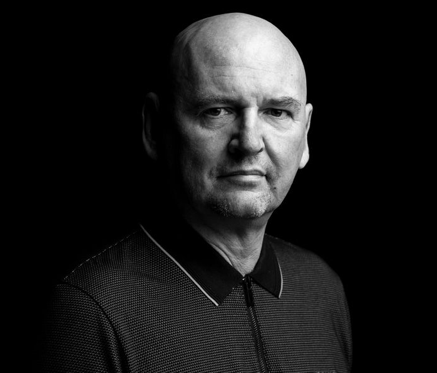

Heiki Kübbar

+372 50 73830

gibs@progmatic.ee